A comparison of itemized deductions vs. the FEIE Standard Deduction for expats

All You Required to Know Regarding the Foreign Earned Income Exclusion and Its Connection to the Standard Reduction

The Foreign Earned Revenue Exclusion (FEIE) provides a vital opportunity for united state residents and resident aliens functioning abroad to decrease their gross income. Comprehending the qualification requirements and declaring procedure is essential. The communication in between the FEIE and the standard reduction can complicate tax obligation strategy. Bad moves in navigating these guidelines can result in missed benefits. Checking out these elements exposes crucial info for efficient tax planning and making the most of monetary advantages.

Recognizing the Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion (FEIE) functions as a necessary tax obligation arrangement for U.S. citizens and resident aliens that work abroad, allowing them to leave out a considerable portion of their foreign-earned income from U.S. government taxes. This arrangement is important for individuals living outside the USA, as it assists reduce the economic concern of double taxes on revenue made in international countries. By making use of the FEIE, eligible taxpayers can minimize their gross income considerably, promoting monetary stability while living and functioning overseas. The exclusion amount is readjusted annually for inflation, guaranteeing it mirrors current economic problems. The FEIE is particularly useful for those in areas with a greater expense of living, as it enables them to preserve more of their earnings. Understanding the technicians and effects of the FEIE encourages expatriates to make educated monetary choices and enhance their tax scenarios while residing abroad.

Eligibility Requirements for the FEIE

To get approved for the Foreign Earned Earnings Exemption, individuals must fulfill details eligibility demands that include the Residency Test and the Physical Visibility Examination. In addition, work status plays an essential function in determining eligibility for this tax obligation benefit. Comprehending these requirements is crucial for anyone seeking to take advantage of the FEIE.

Residency Test Standard

Identifying qualification for the Foreign Earned Earnings Exemption (FEIE) depends upon conference particular residency test requirements. Primarily, people should establish their tax obligation home in a foreign nation and demonstrate residency through either the authentic home test or the physical presence test. The authentic house examination requires that a taxpayer has actually established a permanent home in an international country for an uninterrupted period that extends an entire tax year. This entails demonstrating intent to make the foreign area a principal home. In addition, the taxpayer should display connections to the foreign nation, such as protecting household, work, or real estate links. Satisfying these residency standards is important for getting approved for the FEIE and properly reducing tax responsibilities on gained earnings abroad.

Physical Visibility Test

Fulfilling the residency criteria can likewise be attained via the physical presence examination, which provides a different course for receiving the Foreign Earned Income Exclusion (FEIE) To satisfy this test, a private have to be literally existing in an international nation for at the very least 330 full days during a successive 12-month period. This need highlights the relevance of actual physical existence, rather than just keeping a residence abroad. The 330 days do not have to be successive, enabling adaptability in traveling plans. This test is specifically advantageous for united state people or citizens working overseas, as it enables them to exclude a considerable part of their international earned earnings from united state taxation, thus lowering their total tax responsibility

Employment Standing Demands

Eligibility for the Foreign Earned Earnings Exemption (FEIE) depends upon details work condition requirements that individuals should meet. To qualify, taxpayers have to demonstrate that their revenue is stemmed from foreign resources, commonly with employment or self-employment. They have to be either an U.S. resident or a resident alien and keep a tax home in an international nation. Additionally, individuals must satisfy either the Physical Existence Test or the Authentic Home Test to establish their international standing. Self-employed people have to report their internet earnings, ensuring they do not go beyond the recognized exclusion limits. It's essential for applicants to preserve proper paperwork to validate their insurance claims regarding work status and international earnings throughout the tax year.

How to Assert the FEIE

Eligibility Requirements Clarified

For people seeking to benefit from the Foreign Earned Income Exclusion (FEIE), understanding the qualification requirements is important. To certify, one need to fulfill two main tests: the bona fide home examination or the physical presence examination. The authentic home test uses to those who have developed an irreversible home in a foreign nation for a nonstop period, usually a year or more. On the other hand, the physical visibility test requires individuals to be physically existing in a foreign nation for at the very least 330 days throughout a 12-month duration. FEIE Standard Deduction. In addition, only gained earnings from international sources gets approved for exemption. Meeting these standards is important for taxpayers wanting to minimize their taxed income while residing abroad

Required Tax Forms

How can one properly assert the Foreign Earned Earnings Exemption (FEIE)? To do so, details tax return must be utilized. The primary type needed is internal revenue service Kind 2555, which permits taxpayers to report foreign made revenue and declare the exemption. This type needs in-depth info concerning the person's foreign residency and the earnings earned while living abroad. Additionally, if asserting the exclusion for real estate expenses, Type 2555-EZ might be utilized for simpleness, supplied particular standards are fulfilled. It is essential to assure that all necessary areas of the kinds are finished accurately to avoid delays or issues with the IRS. Comprehending these forms is essential for optimizing the advantages of the FEIE.

Filing Process Actions

Declaring the Foreign Earned Income Exclusion (FEIE) entails a collection of clear and orderly steps. Initially, individuals should determine their qualification, verifying they meet the physical presence or authentic home examinations. Next, they need to complete IRS Kind 2555, detailing earnings made abroad and any suitable exclusions. It is necessary to collect supporting documentation, such as foreign tax obligation returns and evidence of house (FEIE Standard Deduction). After filling up out the kind, taxpayers ought to affix it to their yearly income tax return, commonly Kind 1040. Declaring digitally can enhance this procedure, but ensuring precise info is vital. Individuals need to maintain duplicates of all submitted kinds and sustaining papers for future recommendation in case of audits or queries from the Internal revenue service.

The Requirement Reduction: An Overview

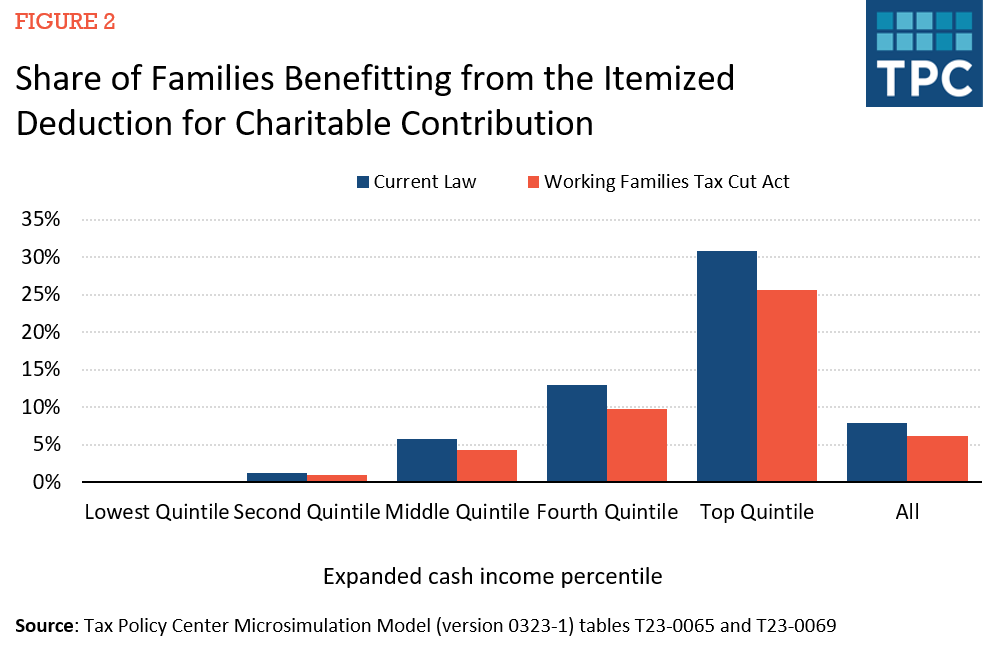

The common deduction acts as a vital tax obligation benefit that simplifies the filing process for lots of people and families. This deduction enables taxpayers to click now lower their gross income without the requirement to detail reductions, making it an attractive alternative for those with uncomplicated monetary circumstances. For the tax year, the standard reduction amount differs based upon declaring standing, with various limits for solitary filers, wedded pairs submitting jointly, and heads of house.

The typical reduction is adjusted every year for rising cost of living, guaranteeing its importance in time. Taxpayers who certify can pick in between the basic deduction and detailing their reductions, generally going with the greater advantage. By supplying a baseline deduction, the basic deduction sustains taxpayers in decreasing their general tax liability, therefore boosting their monetary position. Comprehending the common deduction is vital for reliable tax obligation planning and taking full advantage of prospective savings for family members and individuals alike.

Communication Between FEIE and Conventional Deduction

While both the Foreign Earned Revenue Exclusion (FEIE) and the typical reduction serve to minimize taxable income, their communication can considerably affect a taxpayer's general tax responsibility. Taxpayers who get the FEIE can omit a substantial amount of their foreign-earned income, which might influence their eligibility for the basic reduction. Specifically, if a taxpayer's international income is completely excluded under the FEIE, their gross income may drop below the threshold necessary to declare the standard deduction.

Nonetheless, it is necessary to note that taxpayers can not double-dip; they can not utilize the very same earnings to assert both the FEIE and the basic reduction. When establishing the best technique for tax decrease, this means that cautious factor to consider is required. Ultimately, comprehending exactly how these 2 provisions engage makes it possible for taxpayers to make educated choices, ensuring they maximize their tax obligation advantages while remaining certified with internal revenue service regulations.

Tax Obligation Advantages of Utilizing the FEIE

Utilizing the Foreign Earned Earnings Exclusion (FEIE) can provide notable tax advantages for U.S. residents and resident aliens living and working abroad. This exemption permits qualified individuals to omit a particular amount of foreign-earned earnings from their taxable earnings, which can result in substantial tax obligation cost savings. For the tax obligation year 2023, the original site exemption quantity is up to $120,000, significantly lowering the taxable income reported to the IRS.

In addition, the FEIE can help stay clear of double taxation, as foreign taxes paid on this income might additionally be qualified for reductions or credit ratings. By strategically making use of the FEIE, taxpayers can preserve more of their earnings, enabling boosted economic stability. Moreover, the FEIE can be advantageous for those who qualify for the authentic residence test or physical presence examination, offering adaptability in managing their tax commitments while living overseas. Generally, the FEIE is a useful tool for migrants to maximize their funds.

Usual Errors to Avoid With FEIE and Basic Deduction

What pitfalls should taxpayers be mindful of when claiming the Foreign Earned Revenue Exclusion (FEIE) alongside the typical reduction? One common error is presuming that both advantages can be claimed all at once. Taxpayers need to recognize that the FEIE has to be asserted prior to the typical reduction, as the exemption essentially lowers gross income. Falling short to fulfill the residency or physical existence tests can also bring about ineligibility for the FEIE, causing unanticipated tax liabilities.

Additionally, some taxpayers forget the need of appropriate paperwork, such as maintaining records of foreign earnings and traveling days. Another constant mistake is overlooking the exemption quantity, potentially as a result of inaccurate forms or misconception of tax regulations. Inevitably, people must maintain in mind that asserting the FEIE can impact qualification for specific tax credit ratings, which can complicate their total tax obligation circumstance. Awareness of these pitfalls can aid taxpayers navigate the complexities of worldwide taxes better.

Regularly Asked Concerns

Can I Claim FEIE if I Live Abroad Part-Time?

Yes, a person can claim the Foreign Earned Revenue Exclusion if they live abroad part-time, provided they satisfy the necessary demands, such as the physical presence or authentic home examinations laid out by the IRS.

Does FEIE Influence My State Tax Responsibilities?

The Foreign Earned Revenue Exclusion (FEIE) does not straight affect state tax obligation obligations. States have differing guidelines concerning revenue made abroad, so individuals need to consult their details state tax guidelines for exact advice.

Exist Any Expiration Dates for FEIE Claims?

Foreign Earned Earnings Exclusion (FEIE) insurance claims do not have expiry days; nonetheless, they must be claimed yearly on tax returns. Failing to insurance Full Report claim in a given year may result in lost exemption benefits for that year.

Exactly How Does FEIE Effect My Social Safety And Security Perks?

The Foreign Earned Earnings Exclusion (FEIE) does not directly effect Social Safety advantages, as these advantages are based upon lifetime incomes. Left out revenue might decrease overall earnings, potentially influencing future advantage estimations.

Can I Withdraw My FEIE Insurance Claim After Submitting?

Yes, an individual can revoke their Foreign Earned Revenue Exclusion claim after declaring. This cancellation must be submitted through the ideal tax return, and it will influence their tax responsibilities and potential deductions moving forward.

The Foreign Earned Income Exemption (FEIE) provides a crucial chance for U.S. citizens and resident aliens working abroad to reduce their taxed revenue. Recognizing the Foreign Earned Earnings Exemption (FEIE)

The Foreign Earned Income Exclusion EarningsFEIE) serves as an essential tax important for Stipulation citizens and people aliens who work that, allowing them to exclude an omit portion of section foreign-earned income from Revenue federal taxation. While both the Foreign Earned Revenue Exemption (FEIE) and the basic reduction offer to reduce taxable revenue, their interaction can significantly impact a taxpayer's total tax liability. Making Use Of the Foreign Earned Income Exemption (FEIE) can provide significant tax advantages for United state citizens and resident aliens living and working abroad. Foreign Earned Earnings Exemption (FEIE) insurance claims do not have expiry dates; however, they need to be declared each year on tax obligation returns.